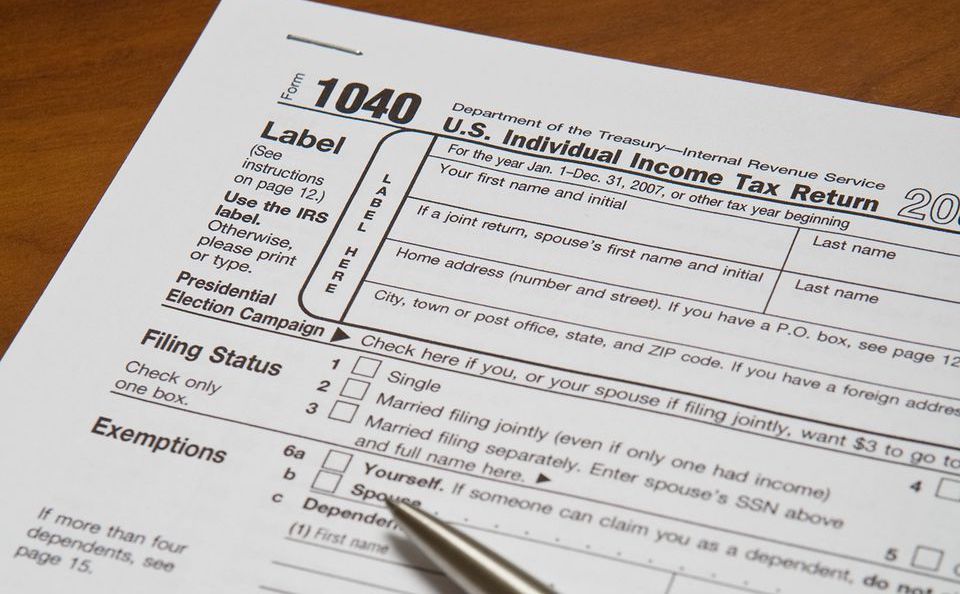

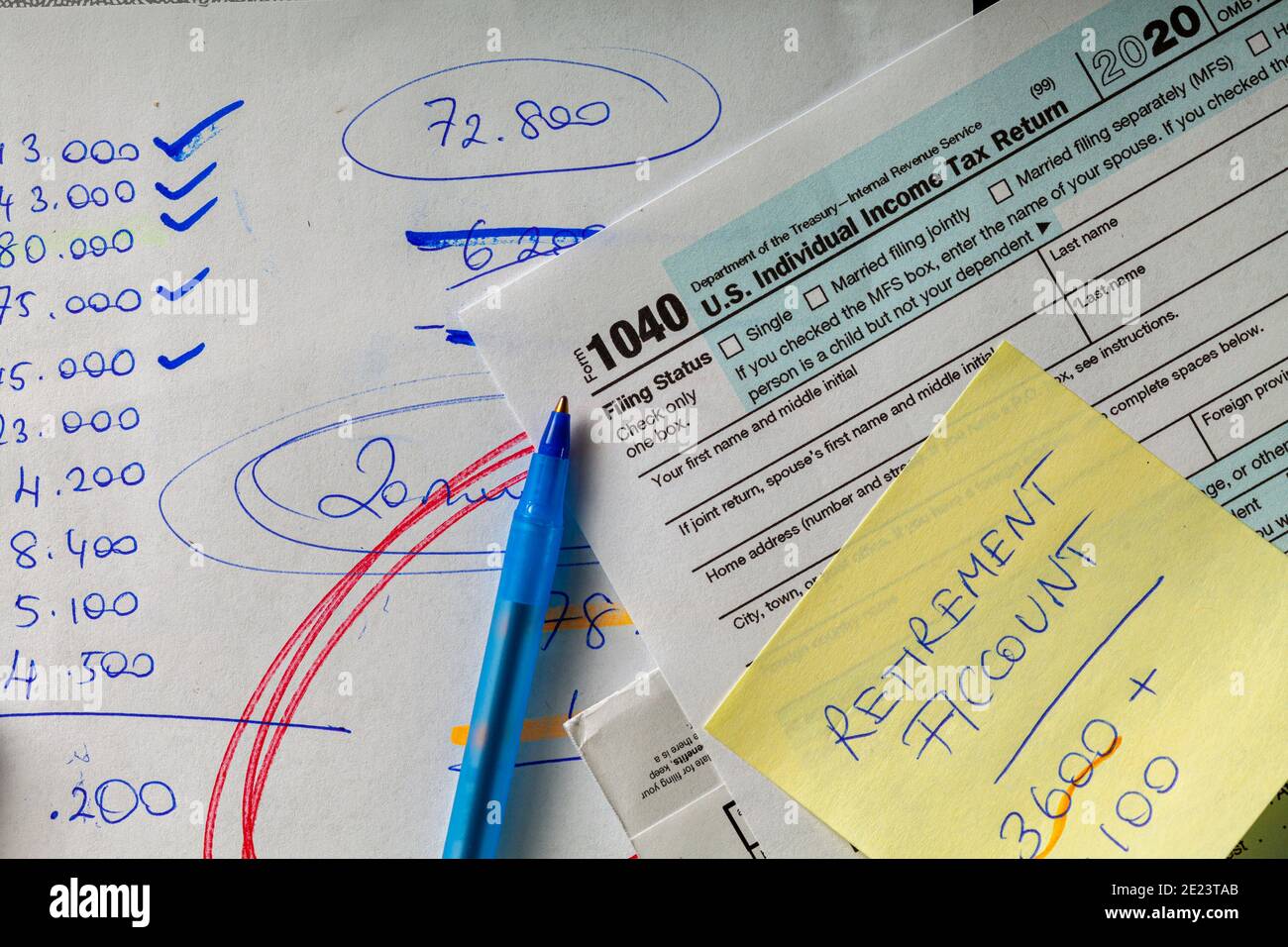

A US Federal Tax 1040 Income Tax Form Editorial Photography - Illustration of wood, internal: 141377727

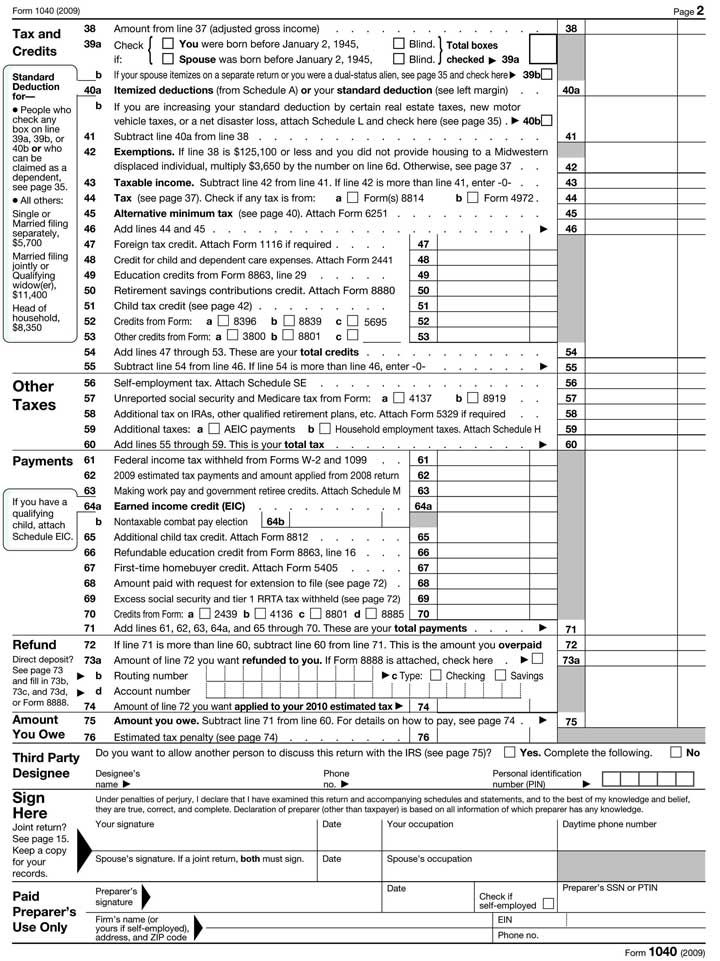

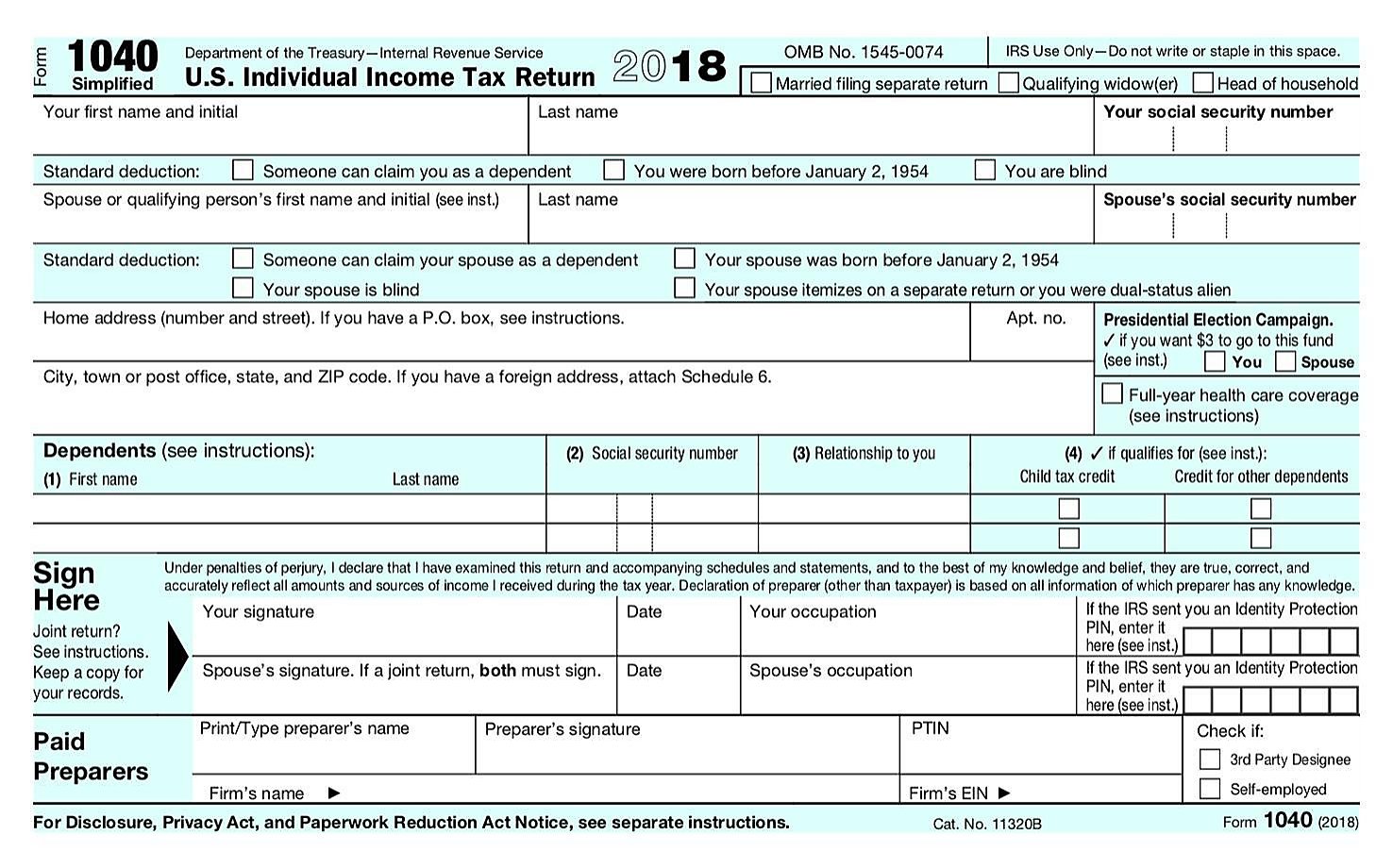

IRS kicks off 2020 tax filing season with returns due April 15; help available on IRS.gov for fastest service - Eagle Pass Business Journal

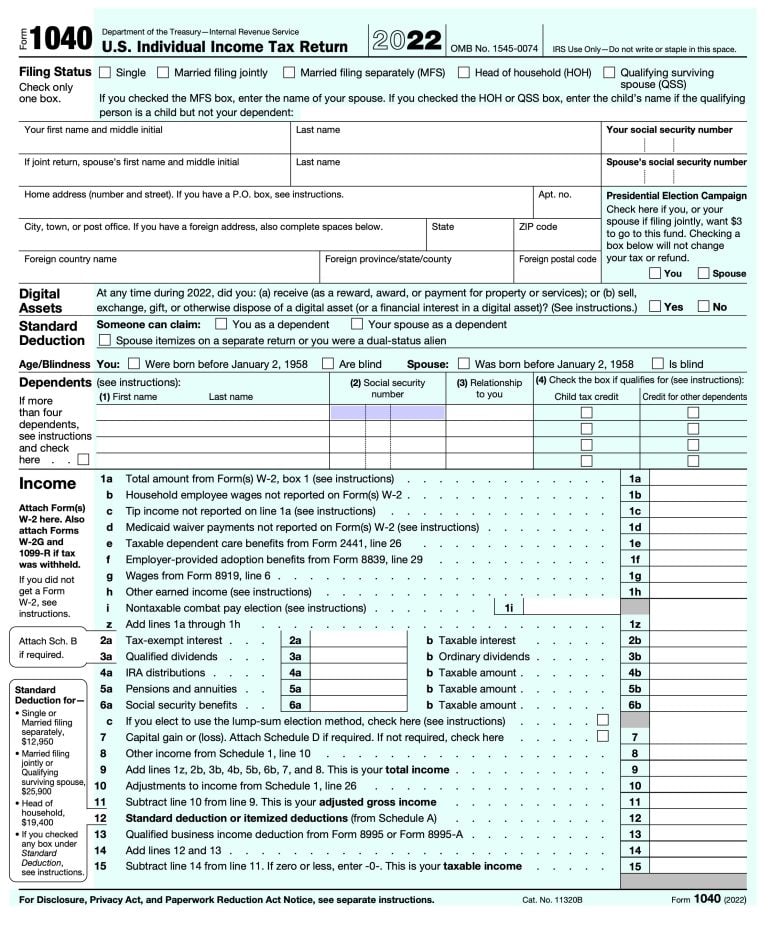

:max_bytes(150000):strip_icc()/Form1040copy-7af98beb63114d4ab3f7a999ba1f3608.jpg)