Alienwork Orologio Automatico Uomo Donna Argento Bracciale in Acciaio Calendario Data Verde Multi-funzione Fondo in Vetro : Amazon.it: Moda

Alienwork Orologio Automatico Uomo Donna Argento Bracciale in Acciaio Calendario Data Verde : Amazon.it: Moda

TSAR BOMBA Orologio Uomo Automatico - Orologi Scheletro Tonneau di Lusso - Vetro Zaffiro con Movimento Giapponese - Impermeabile 50M - Luminoso : Amazon.it: Moda

Alienwork Orologio Automatico Uomo Donna Argento Bracciale in Acciaio Calendario Data Nero : Amazon.it: Moda

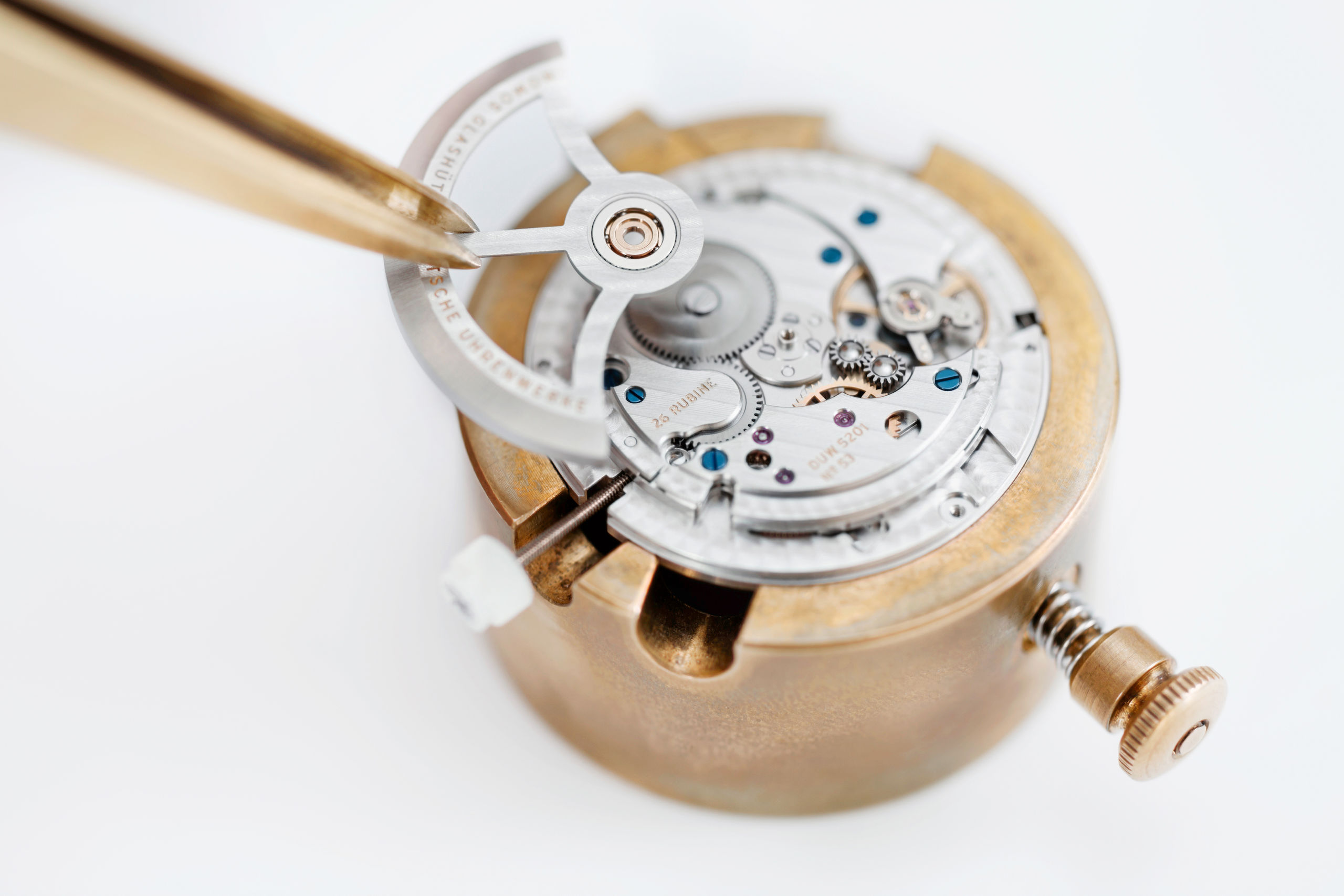

High-beat vs low-beat: qual è la differenza tra orologi ad alta e bassa frequenza? - Il magazine di Chrono24

TSAR BOMBA Orologio Uomo Automatico - Orologi Ceramica Scheletro Tonneau di Lusso - Vetro Zaffiro con Movimento Giapponese - Impermeabile 50M - Luminoso : Amazon.it: Moda

TSAR BOMBA Orologio Uomo Automatico - Orologi Scheletro Tonneau di Lusso - Vetro Zaffiro con Movimento Giapponese - Impermeabile 50M - Luminoso : Amazon.it: Moda